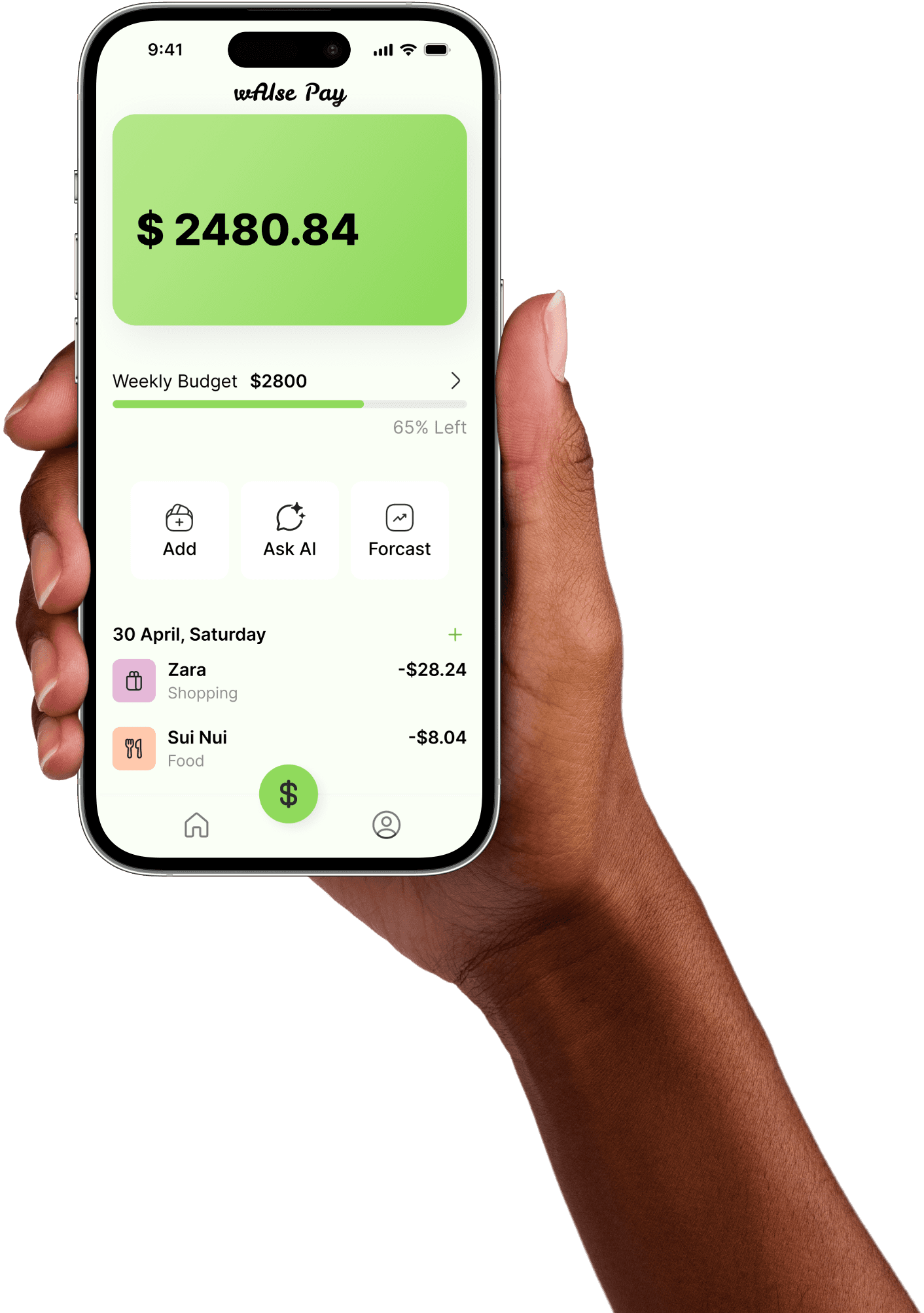

The wAIse Pay app forecasts the weekly budget for users through AI analytics to control their leisure expenses.

Users often end up over-spending their money. Lack of control on budget hinders their ability to achieve financial goals.

Encourage users to make informed decisions to control their impulsive spending?

Led end-to-end design and development from concept to execution alongside cross-functional teams.

Product Designer (me)

Product Manager

Engineering Team

20% increase in monthly savings for users by controlling their impulsive expenses.

User-centered

design

Design for

accessibility

Intuitive

interfaces

Design

consistency

notable features

Weekly budget through AI

Literature Review

Market Research

User Research

MVP & Critiques

Usability Testing

Approach was to design a scalable mobile application that can be accessible to everyone.

looking at what already exist

We wanted to study the existing market, users, and footfall in this area, so we decided to analyze competitors.

We got to know the strengths and weaknesses of existing apps, helping us identify opportunities for improvement.

looking at what already exist

Budgeting small expenses

People often focus on big investments and long-term goals. Small budget goals are often neglected.

Future expense

Lack of predictive analytics to based on users' spending patterns that hinders financial planning for upcoming commitments.

Personalized guidance

AI in finance is expected to revolutionize and to create more sensible experiences.

The Challenges faced

Diverse user needs for business expansion

Financial freedom looks different for everyone.

Design for accessibility

Understanding the pattern in the user pain points and create customizable features.

User engagement

Keeping track of small expenses is a tedious work.

Gamification

Study gamified trends to implement intuitive features that are functional without making the app feel geeky.

Financial freedom looks different for everyone.

Pain point

1

Pain point

2

User Need

User Interviews + Contextual Inquiry

We conducted user interviews to understand how people manage their monthly expenses.

Observations helped us uncover how users track and make decisions about their leisure expenses in real-life situations.

Unavoidable expenditure

Rent, taxes, loan, daily commute, utility bills, etc.

For long term goals

Fixed deposit, recuring deposit, investments, etc.

Spent on essential things

Grocery, personal care, food, medical expenses, etc.

Spent according to interests

Leisure activities, personal hobbies, entertainment, etc.

Problem

Impulsive spending is happening in the remains.

Opportunity

Promote understanding of unforeseen expenditures.

Opportunity

Tell them where to control

So that they can save better for their long-term financial goals.

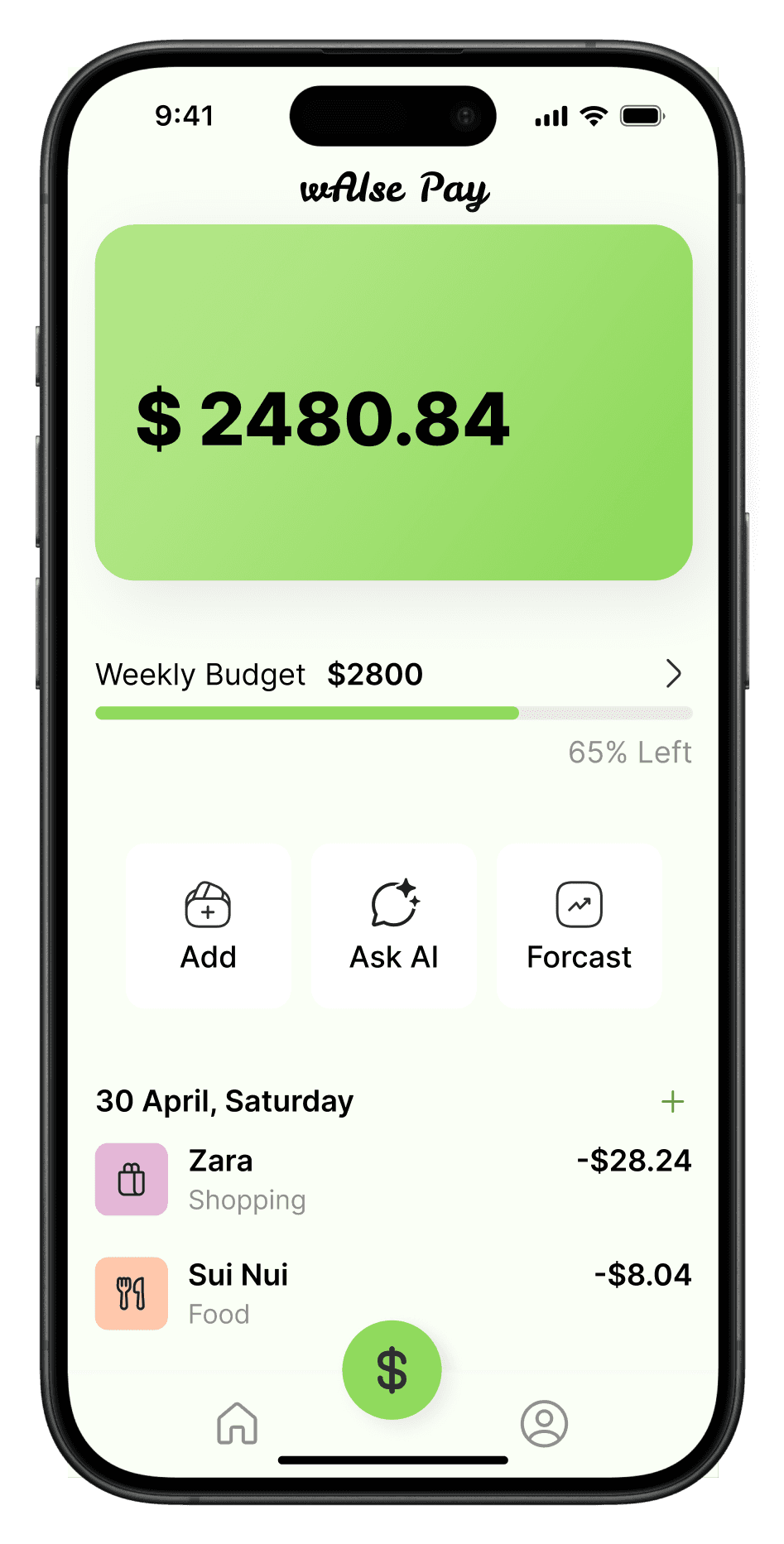

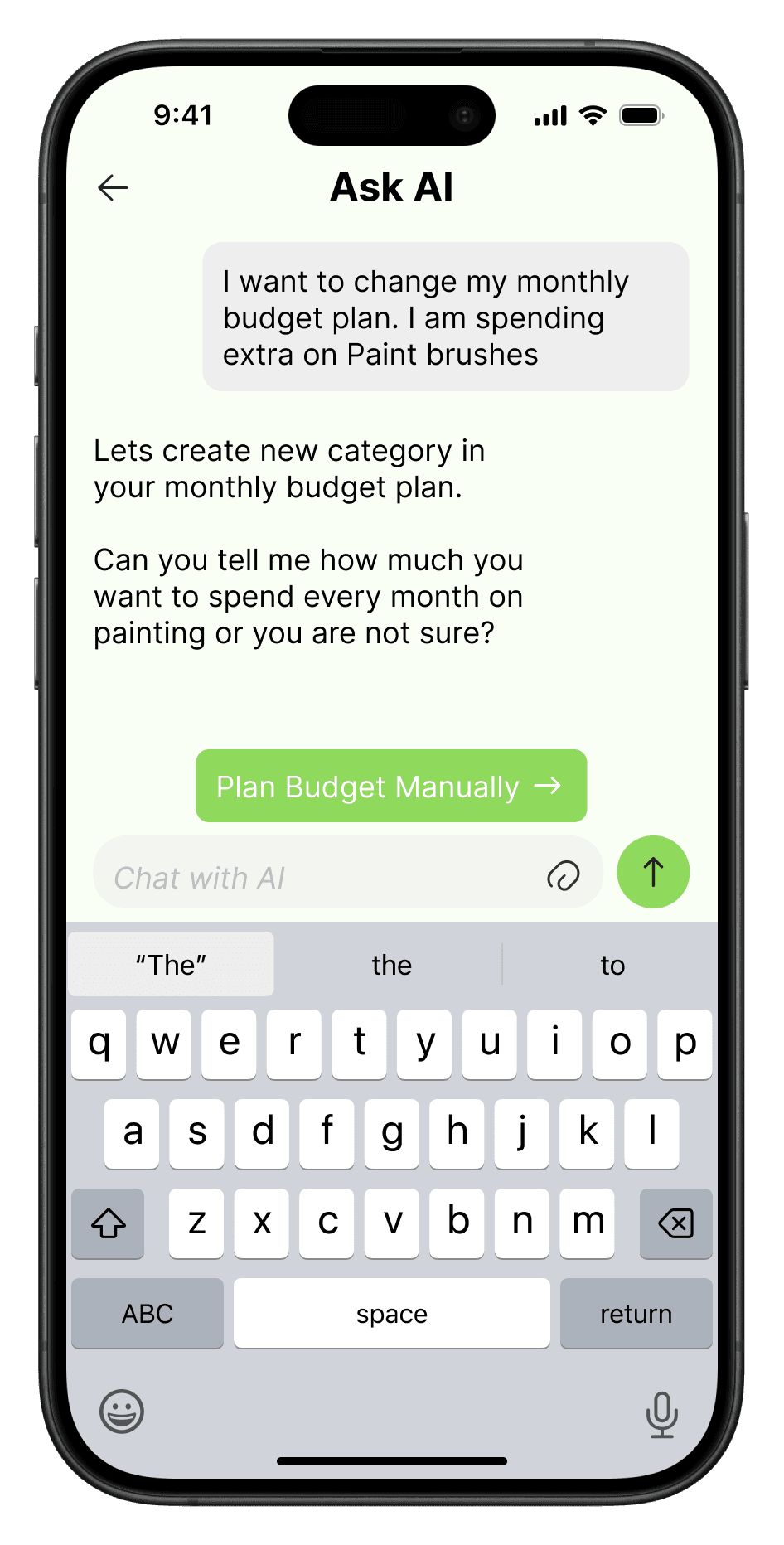

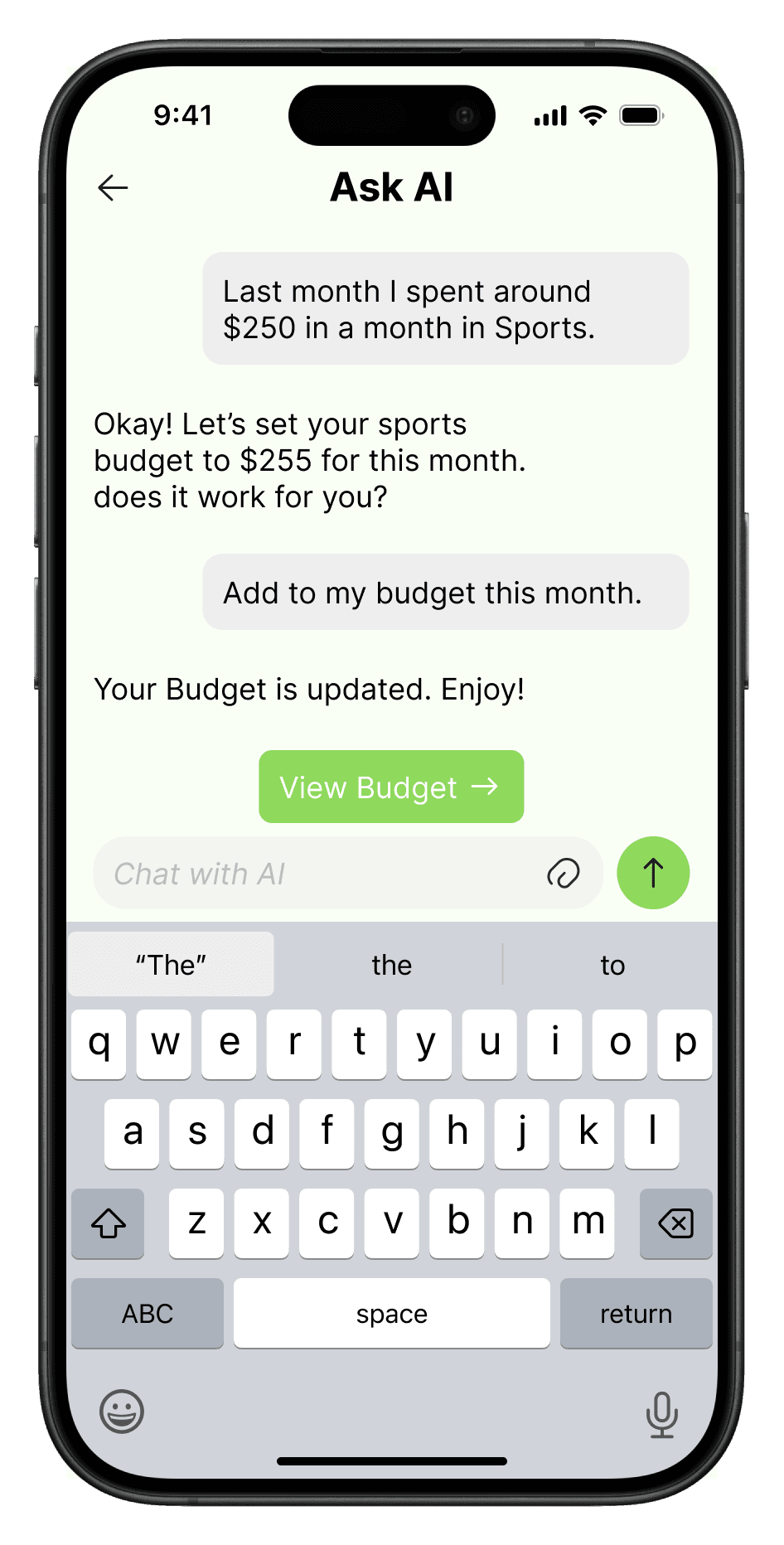

Forecast future budget

Through predictive analytics from past expenses.

Get weekly budget

Personalized weekly budget through user data collection and insights

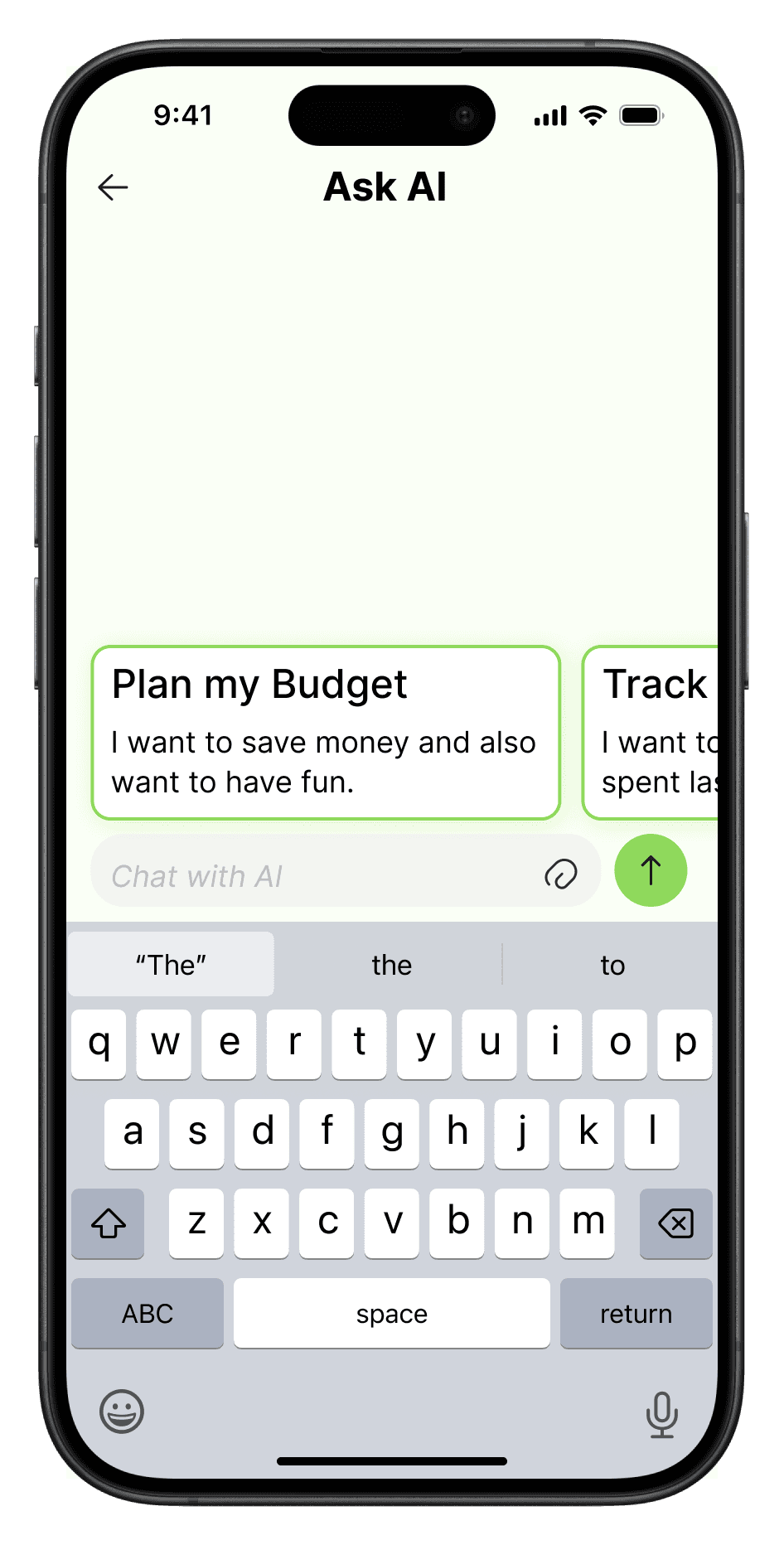

AI Assistance

Data monitoring through integrated payment systems.

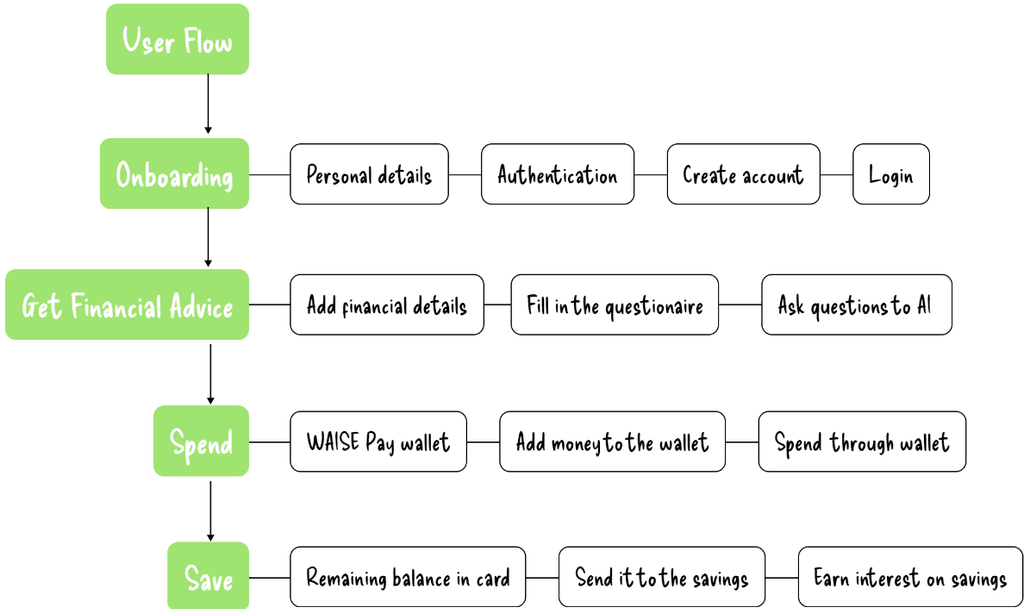

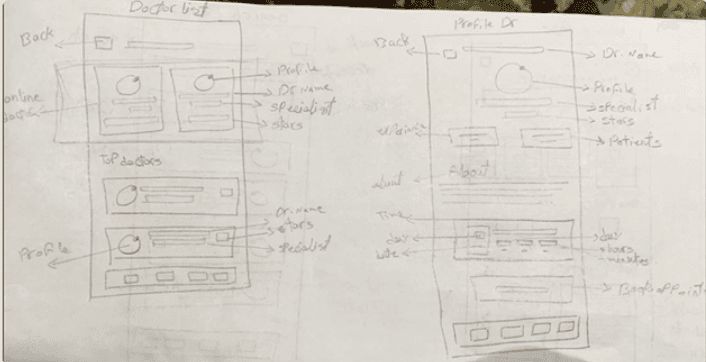

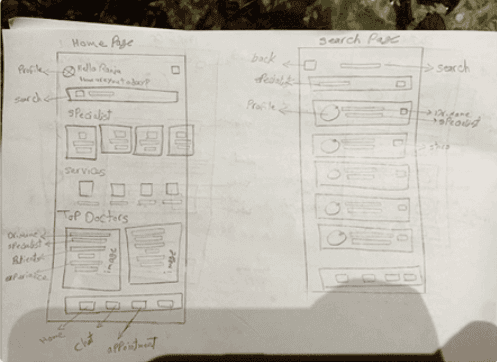

Paper Sketches + Low-fidelity + Style guides

Existing design systems aside, sketching ideas on paper helped us to visualize design ideas first.

Core Tasks

Ask Ai your weekly budget

View balance

Perform transactions

View analytics

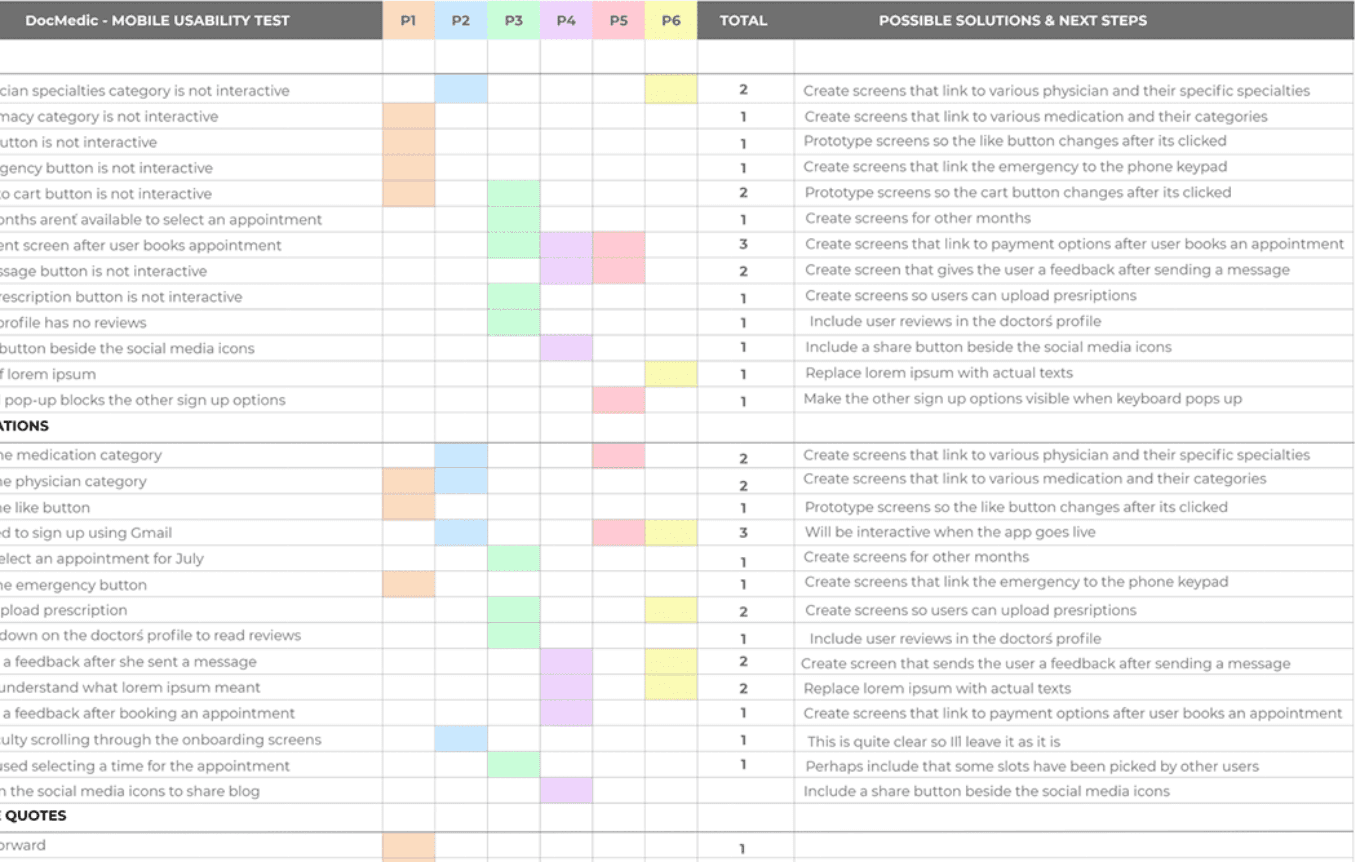

Usability study

Feature Walk through + Unmoderated usability testing

We conducted three rounds of usability testing to test our MVP: One with a paper prototype, one with low-fidelity wireframes, and the final with high-fidelity designs.

For the first two phases, we only interviewed personas, while for the high-fidelity designs, we tested with a broader range of users.

User 1

"I take out my iPad when I feel low and I eventually start adding items to cart. Next thing I know is my order is placed".

User 2

"I want to see this app on my Apple watch so that I can make purchasing decision quicker ".

What's next?

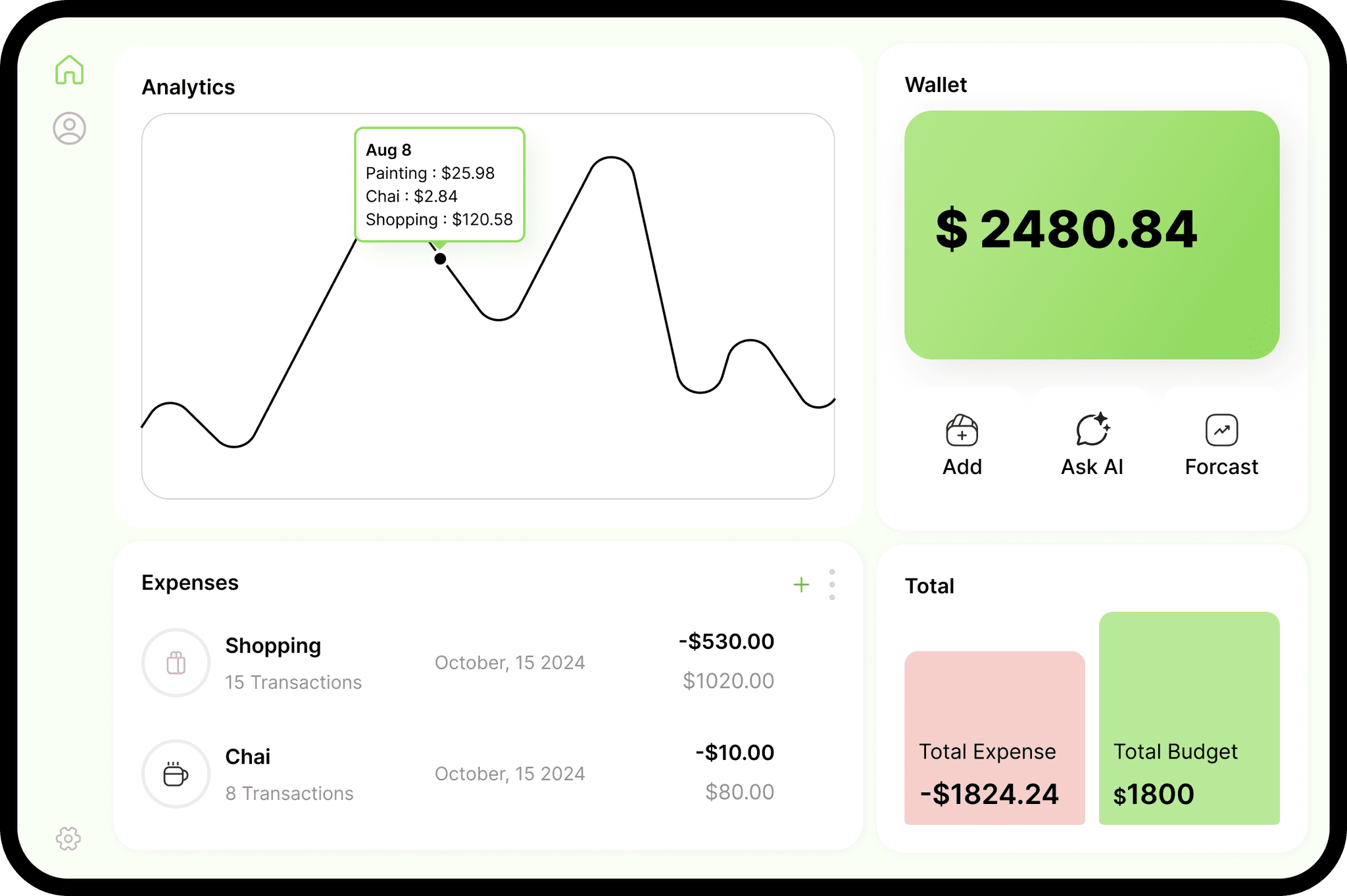

After conducting usability testing phase one, we designed MVP for tablet. This did not only solve user problem but also helped us to make scalable design.

UI for tablet screen

36% of shopaholics make use of iPads and tablets when making online purchases.

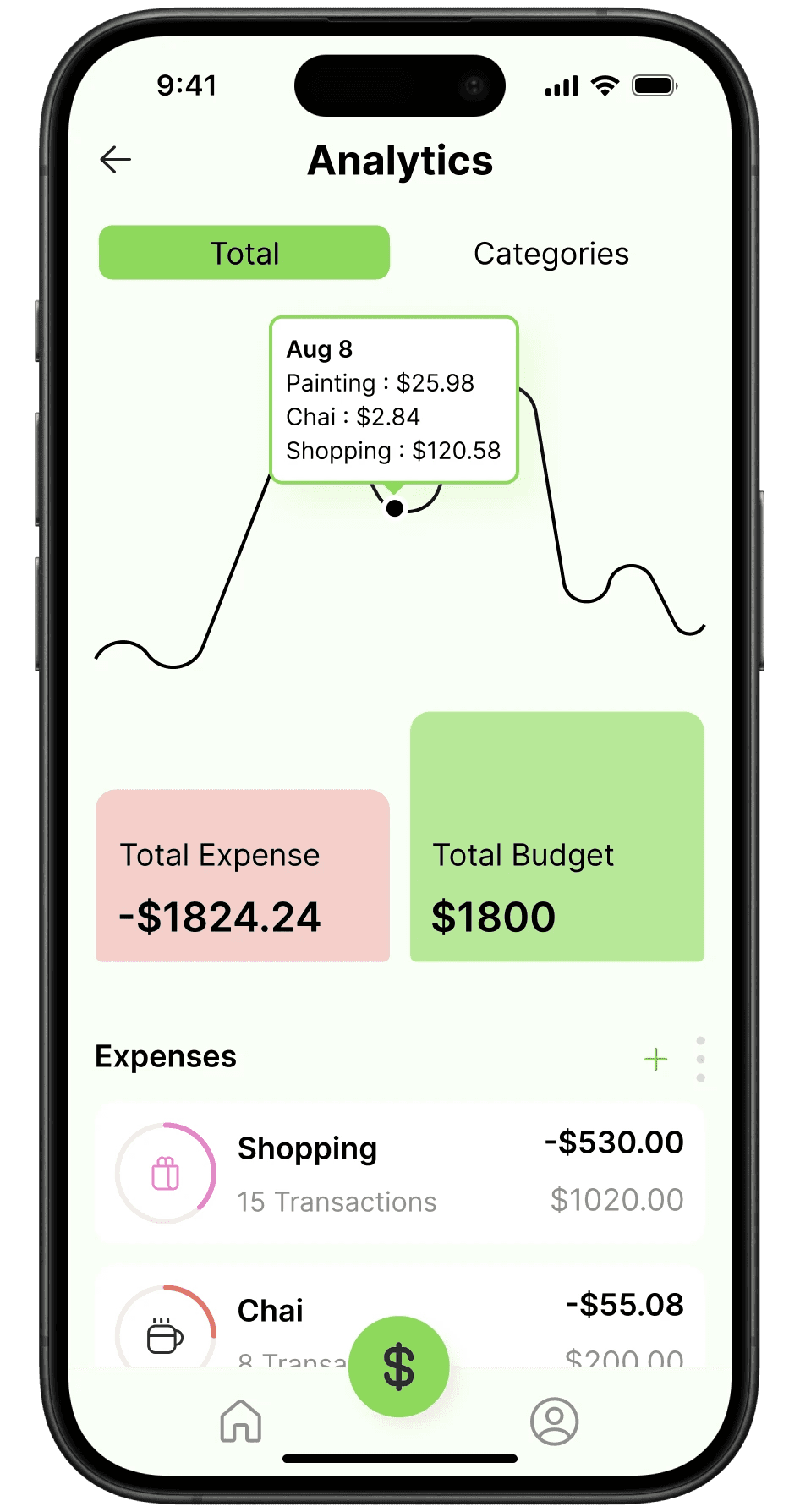

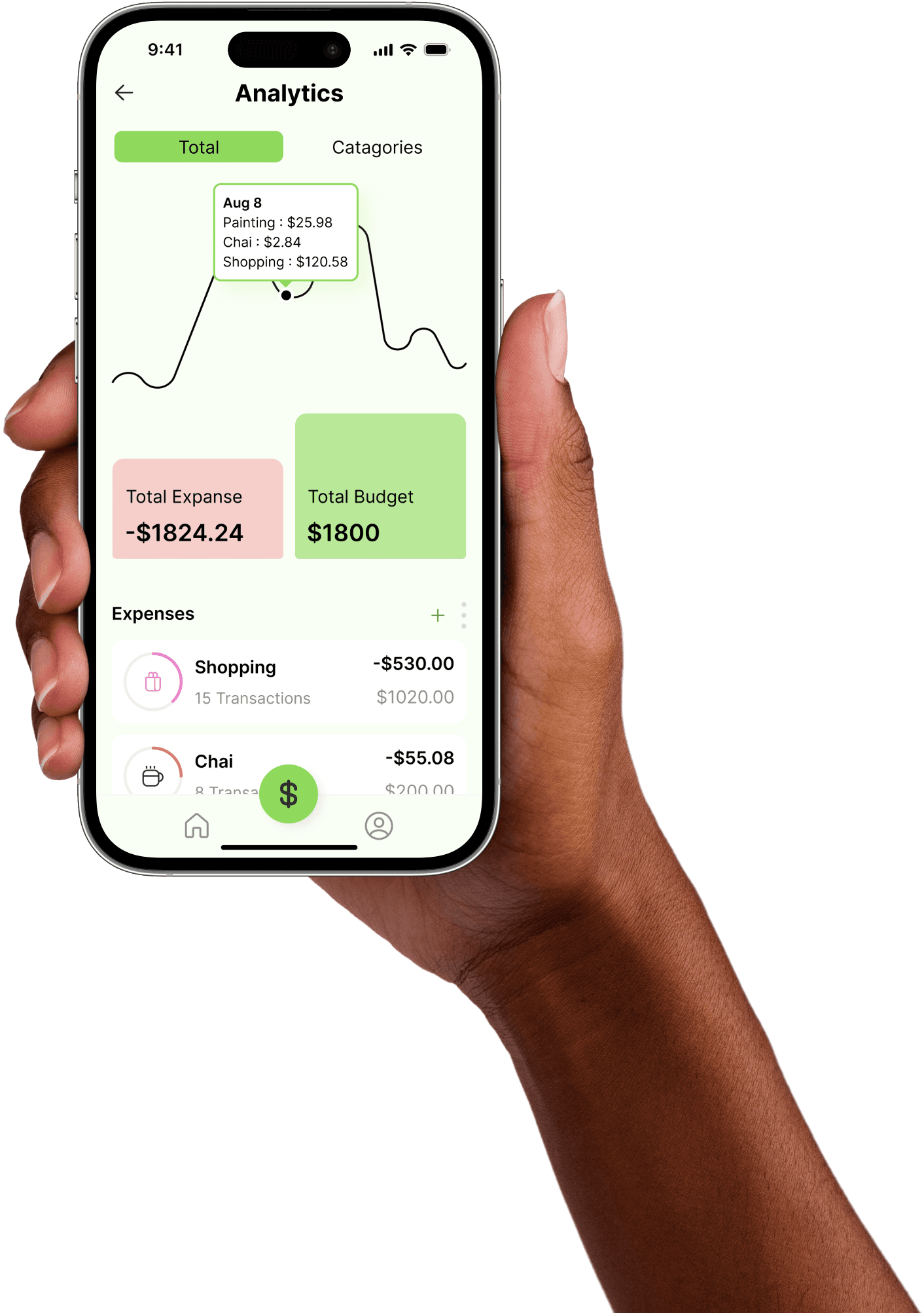

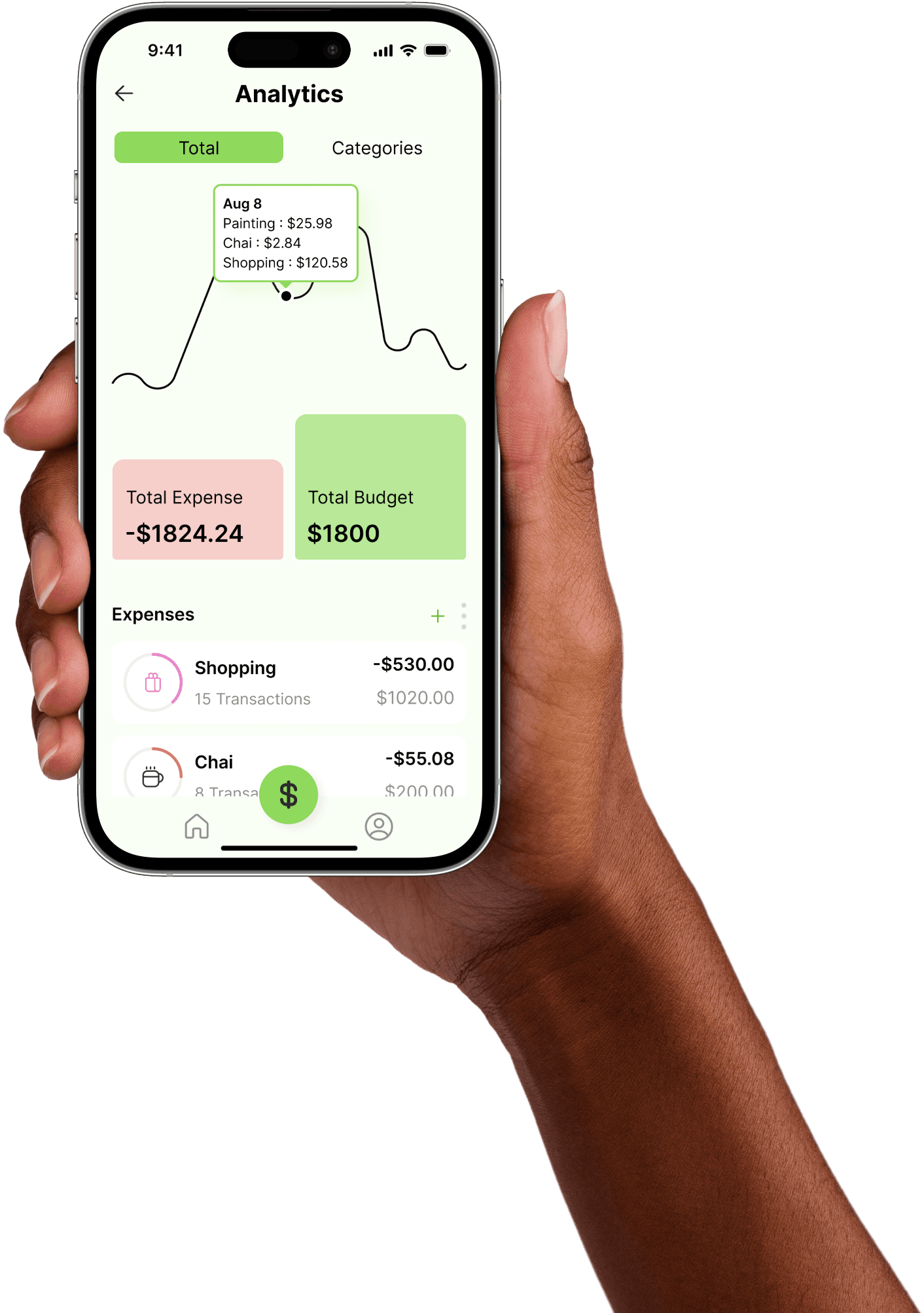

Expense of the day on analytics graph

This feature will help users make more precise decisions in advance.

MVP for tablet screen

Budget Analytics

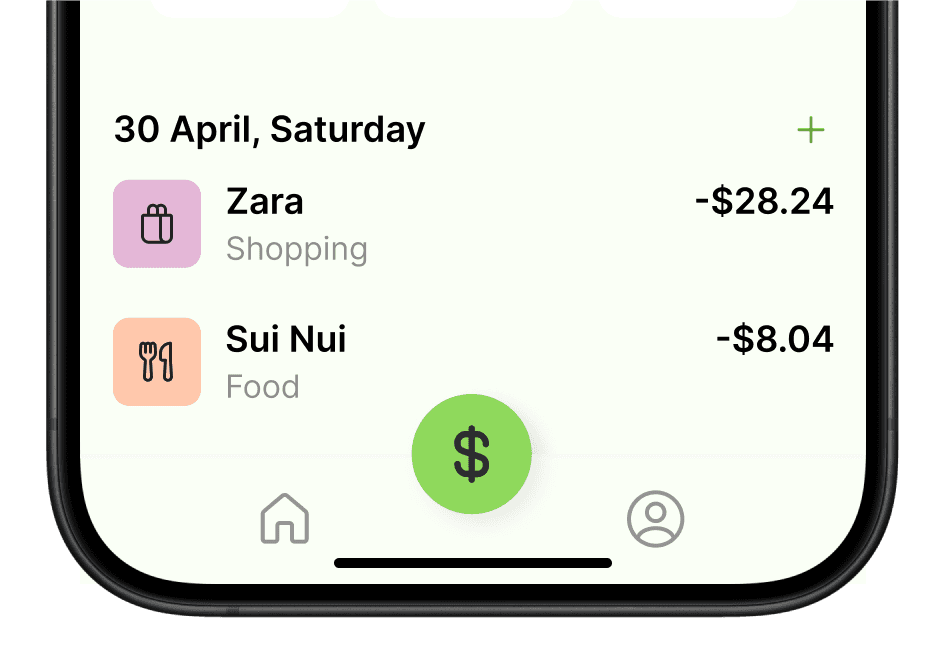

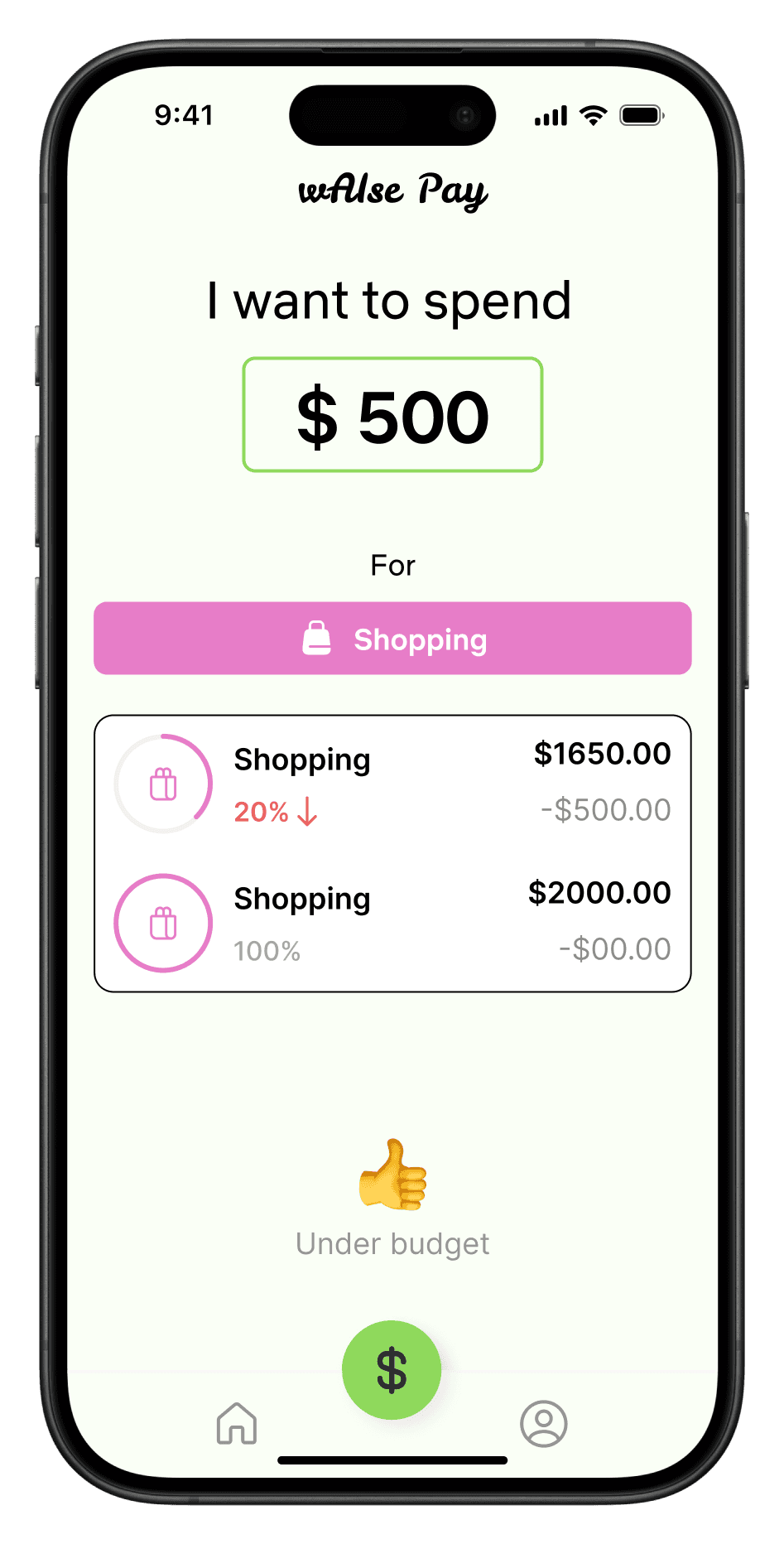

Spend through app to keep the track

Adding funds to the app just for user's leisure expenses automatically limits spending. Categorized weekly budget make it easier for users to manage finances.

Add third party transactions

Adjust weekly budget manually

Micro interactions

Gestalt law principles

We considered feedback from different demographic users